Increase Your Exposure

One of the most common tools in the trading world, leverage allows you to invest much more in your trades, with relatively small deposit amounts, (which is your margin).

What is leverage in forex? Think about it as a loan. If you have capital of $1,000 and borrow $100 for every dollar from your broker, you will have $100,000 to trade with. So now, if the EUR/USD rate moves 100 pips, from 1.1273 to 1.1373, you will have $100,000 to open a deal, in place of $1,000. This means that you can trade much larger lots and increase your exposure to the markets.

RISK WARNING: Leverage also comes with suspential risk, so it is important to understand the risks that comes with leverage before trading.

Trade with up to 500:1 Leverage on FX Pairs

- Minimises the amount of capital you need to invest. Rather than paying the full asset price, you only need to pay a portion of it.

- Provides the opportunity to trade in more expensive instruments with high liquidity, even if you have a small amount of capital to invest.

- Increases your exposure to the markets, allowing you to enter much larger trades than you would with just your own capital.

It is important to remember, however, that leverage magnifies both your profit and your loss potential. So, make sure that when you choose a leverage ratio, regardless of the assets you trade, forex, equity, commodities, indices, you first assess your risk tolerance.

FP Markets offers leverage of up to 500:1 on positions in FX and precious metal CFDs, along with stop losses, so that you can make the most of price movements, while ensuring robust risk management measures.

See an example of

how Leverage works

Example: Trader A

Example: Trader A has $5000 USD – If Trader A has an account leverage of 10:1 and they wish to use $1000 on one trade as margin, they will have exposure of $10,000 in base currency ($1000) = 10 x $1000 = $10,000 (trade value).

Example: Trader B

Example: Trader B has $5000 USD – If Trader B has an account leverage of 100:1 and they wish to use $1000 on one trade as margin, they will have exposure of $100,000 in base currency ($1000) = 100 x $1000 = $100,000 (trade value).

FP Markets

MT4 Leverage Conditions

| LEVERAGE | MAXIMUM EQUITY BALANCE | |

|---|---|---|

| 500 : 1 | $10,000 | |

| 400 : 1 | $25,000 | |

| 300 : 1 | $50,000 | |

| 200 : 1 | $100,000 | |

| 100 : 1, 50 : 1, 25 : 1, 1 : 1 | NO EQUITY BALANCE RESTRICTIONS |

Trade with Up to 500:1 Leverage

on FX Pairs

As an ASIC-licensed broker, we offer:

- Robust risk management tools on platforms like MT4 and MT5

- Leverage trading in over 10,000+ assets, including forex, metals, indices, commodities and more

- Advanced charting tools and indicators on the most popular trading platforms to monitor price action

We do not recommend unnecessarily high leverage on risky assets.

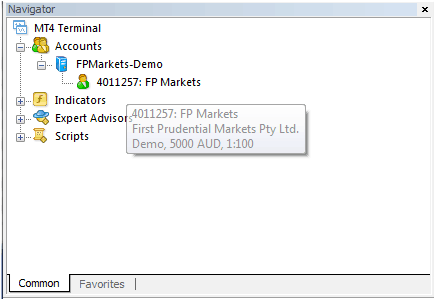

How to check your

leverage in MT4

Leverage trading on MT4 is easy. Simply go to the “Navigator” window and click on “Accounts,” and then hover your mouse over the account number. You will see your base currency and leverage ratio. It is also easy to learn how to change your leverage on MT4.

可交易全球一万多个金融产品

可交易全球一万多个金融产品